Reduce the cost of integrating electric vehicles for your municipality.

Purchase electric

Driving electric will:

- Reduce maintenance costs and down-time because the brakes last much longer and there’s no need for oil changes with electric vehicles;

- Drive more efficiently because of the regenerative braking. Electric vehicles generate energy when you slow down compared to a regular car that wastes energy while slowing down;

- Create a healthier environment for everyone in your community because electric vehicles do not produce tailpipe emissions into the air we all breathe.

See how municipalities are driving electric.

Okotoks 2019 Polaris Ranger EV

Banff Chevrolet Bolt and Proterra Parkade Sweeper BEV

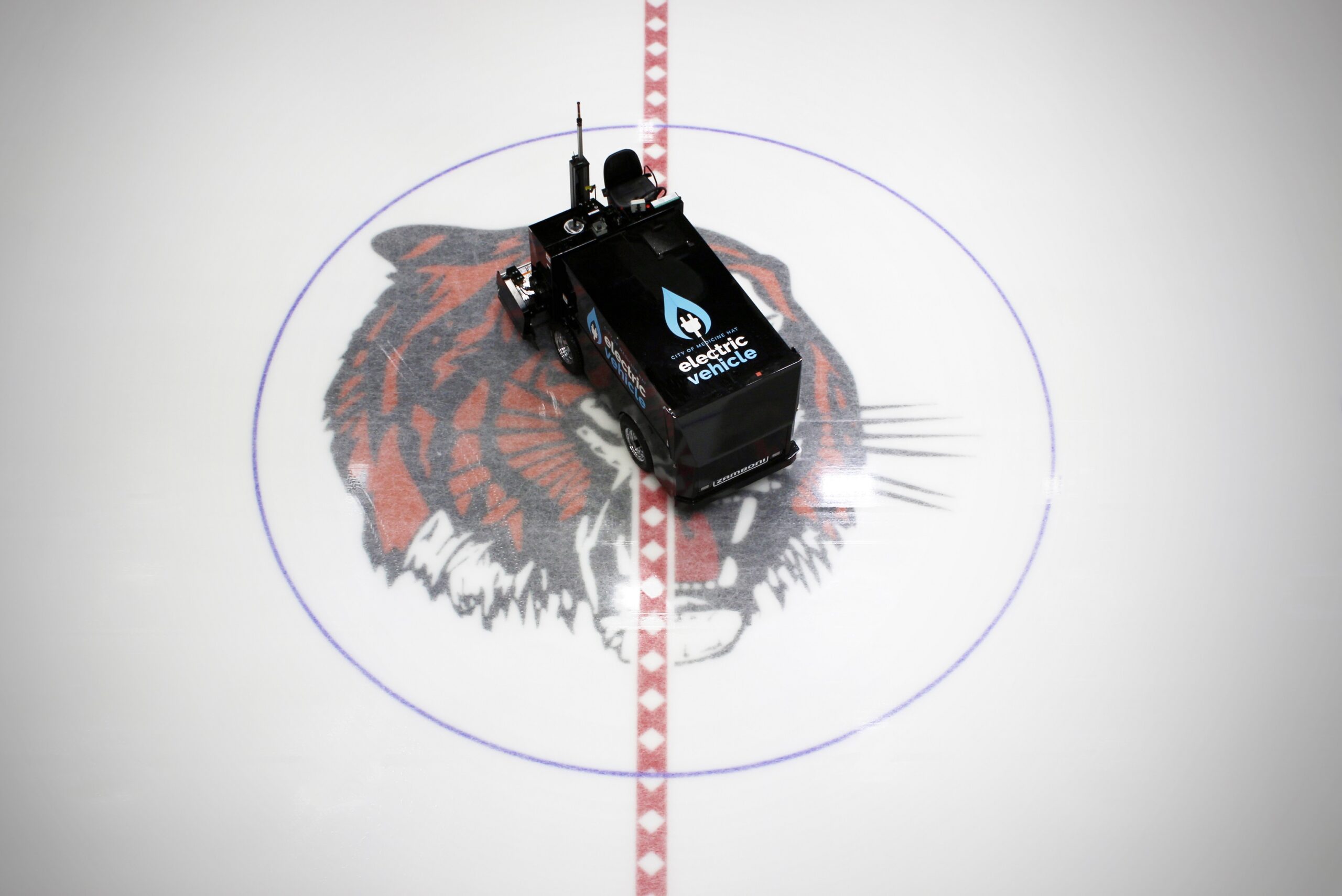

Medicine Hat Electric Zamboni 450s

$3,150,000 in rebates to municipalities

83 projects completed by 50 municipalities

365 tonnes CO2e of GHG emissions avoided annually

SMALL CHANGES MAKE A HUGE DIFFERENCE

Over 160 municipal governments in Alberta created real savings and real change. City, Town, Village, Summer Village, County, Municipal District – no community is too big or too small to participate.

Upgrading lighting, thermostats, heating and ventilation systems, installing solar PV systems, implementing weatherization measures, integrating electric vehicles into the municipal fleet, and hiring an energy manager – it all adds up to millions of dollars in annual energy savings for Albertans.

Success Stories

Boiler Upgrades – Town of Athabasca

With support from a rebate, the Town of Athabasca replaced the boiler in their Old Brick School.

Okâch – Îyethkabi Oûgitûbi Pavilion Solar PV System – Town of Banff

Banff completed the Okâch – Îyethkabi Oûgitûbi Pavilion solar photovoltaic (PV) system project through the Municipal Electricity Generation (MEG) program.

Protective Services Solar PV System – City of Spruce Grove

In 2025, the City of Spruce Grove completed the Protective Services solar photovoltaic (PV) system project through the Municipal Electricity Generation (MEG) program.

Tip: Read our blog post that puts five electric vehicle myths to rest.

Who could apply

Municipalities within Alberta were eligible to receive funding for multiple electric vehicles to transition fleet vehicles towards more fuel-efficient options, such as battery electric vehicles and plug-in hybrid electric vehicles.

Eligible projects included:

- Feasibility studies

- Low-speed, non-road battery electric and plug-in hybrid electric vehicles

- Passenger battery electric and plug-in hybrid electric vehicles

- Medium and heavy-duty battery electric and plug-in hybrid electric vehicles

Tip: Additional funding is available from the federal government through the Incentives for Zero-Emission Vehicles (iZEV) Program. Municipalities accessing both funding sources received rebates of up to $19,000 per passenger vehicle.

Funding

Feasibility Studies

Feasibility studies help you explore potential economic and environmental impacts from transitioning to an electric fleet. Get a feasibility study completed by one of the pre-qualified consultants. Only one Feasibility Study per municipality.

| Funding |

| 50% of the pre-GST total cost to a maximum of $6,000. |

Low Speed, Non-Road Battery Electric and Plug-in Hybrid Electric Vehicles

Purchase or lease of new, low speed, non-road vehicles such as electric ice resurfacing vehicles or utility task vehicles.

Type | Examples | Funding |

| Battery Electric and |

Polaris GEM, CanEV Might-E Truck | 30% of costs up to $50,000 per vehicle |

| Battery Electric Ice Resurfacers | Olympia IceBear Electric, Zamboni Model 450, Engo Electric Ice Resurfacer | 30% of costs up to $50,000 per vehicle |

Passenger Battery Electric and Plug-in Hybrid Electric Vehicles

Purchase or lease of new passenger vehicles, such as electric sedans, sport-utility vehicles, or trucks.

| Type | Examples | Funding |

| Plug-in Hybrid Electric Vehicles (battery capacity of 4 to 14.9 kWh) | Toyota Prius Prime, Mitsubishi Outlander | $7,000 |

Plug-in Hybrid Electric Vehicles (battery capacity of 15+ kWh) | Chevrolet Volt, Chrysler Pacifica | $14,000 |

Battery Electric Vehicles (battery capacity of 15+ kWh) | Hyundai Kona EV, Chevrolet Bolt, Kia Soul Electric | $14,000 |

Medium and Heavy-Duty Battery Electric and Plug-in Hybrid Electric Vehicles

Purchase or lease of new medium or heavy-duty vehicles such as electric garbage or yard trucks.

| Type | Examples | Funding |

| Battery Electric and | BYD 8R, Lion8 Refuse Truck | 30% of costs, up to $300,000 per vehicle |

All Battery Electric Vehicles and Plug-in Hybrid Electric Vehicles (Leased Vehicles)

| Lease Period | Portion of Funding |

|

12-23 Months |

25% |

|

24-35 Months |

50% |

|

36-47 Months |

75% |

|

48+ Months |

100% |

You must be logged in to post a comment.